Why Is the Estimation of Metaorder Impact with Public Market Data So Challenging?

Introduction

In financial markets, metaorders—large trades executed gradually over time—have a significant impact on asset prices. Understanding and estimating this market impact is crucial for traders, institutional investors, and financial analysts. However, obtaining accurate estimates using public market data presents unique challenges.

A recent study by Manuel Naviglio, Giacomo Bormetti, Francesco Campigli, German Rodikov, and Fabrizio Lillo explores why standard market impact models fail to accurately capture the price movements associated with metaorders. The study introduces a modified Transient Impact Model (TIM) that provides more realistic price trajectory estimations.

This blog post examines the key findings from their research and discusses why public market data alone is often insufficient for estimating metaorder impact.

Understanding Market Impact and Metaorders

1. What is Market Impact?

Market impact refers to the price change caused by the execution of a trade. Large orders can move prices significantly, which leads to higher transaction costs for institutional investors.

Market impact has two primary components:

- Immediate (or transient) impact: The price moves as soon as a trade is executed.

- Permanent impact: The lasting price change after the trade is completed.

2. What Are Metaorders?

A metaorder is a sequence of orders that are part of a larger trading strategy. Instead of executing a large trade at once (which can cause excessive price impact), traders break it down into smaller "child orders" spread over time.

The price trajectory of a metaorder follows a distinct pattern:

- Prices typically increase non-linearly during the execution.

- After completion, prices partially revert to pre-trade levels.

However, when market impact models are built using public data, they often fail to replicate these patterns accurately.

The Challenge of Estimating Market Impact with Public Data

1. Public Market Data Misses Critical Information

Public market data only includes observable trades and prices, but it does not provide insights into:

- Who is trading (retail vs. institutional investors).

- Hidden liquidity (orders placed in dark pools or internal trading desks).

- Execution strategies used by traders.

Since metaorders are often executed algorithmically and spread across multiple venues, public data only captures a fraction of the full picture.

2. Standard Market Impact Models Do Not Match Real-World Behavior

Most market impact models assume that prices follow a concave trajectory (slowing down as the metaorder progresses) and that there is a sharp price reversion once the order is complete.

However, when these models are calibrated using public market data, they produce:

- A nearly linear price increase during execution (instead of a concave curve).

- Minimal price reversion after execution (instead of a sharp decline).

This discrepancy suggests that statistical models calibrated on public data may overestimate the impact of each child order on the overall market.

3. Market Impact is Noisy and Requires Large Datasets

Even if we had access to execution data, market impact is inherently noisy due to:

- Random price fluctuations unrelated to order flow.

- Liquidity changes throughout the trading day.

- Reactions from other market participants adjusting their strategies.

To accurately estimate market impact, we need large datasets covering multiple assets, time periods, and market conditions—something that is rarely available in public datasets.

A New Approach: The Modified Transient Impact Model

The Study’s Key Contribution

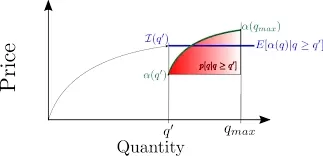

To address these challenges, the authors propose a modified version of the Transient Impact Model (TIM). Their approach introduces a parameter, α, that controls how much of the metaorder’s execution triggers new market activity.

Key Insights from the Model

- Instead of assuming that all child orders equally influence the market, the model adjusts for the actual fraction that causes price movement.

- When α is tuned correctly, the model reproduces the observed concave price trajectory seen in real-world metaorder executions.

- In some conditions, the model predicts a permanent market impact, meaning that prices do not fully revert after execution.

Implications for Market Participants

- Traders and Algorithmic Execution Strategies: This model helps design execution strategies that minimize market impact.

- Regulators and Market Structure Analysts: Understanding how different order execution methods affect liquidity can improve market regulations.

- Market Makers and Liquidity Providers: A more accurate impact model helps assess risk when providing liquidity.

Conclusion: A Complex Problem Without a Simple Solution

Estimating metaorder market impact using public data is challenging because:

- Public data lacks crucial information about order execution strategies.

- Traditional models fail to replicate real-world price trajectories.

- Market impact is noisy and requires extensive data to estimate accurately.

The study highlights the need for better models that account for order flow autocorrelation and liquidity dynamics. By modifying the Transient Impact Model, the researchers propose a more accurate way to estimate the market impact of metaorders—offering insights that could reshape trading strategies and market structure analysis.

While this is a step forward, no single model can fully capture the complexities of financial markets. Continued research, access to richer datasets, and advanced machine learning methods will be key to improving market impact estimation in the future.

What Do You Think?

Should trading firms share more execution data to improve market impact models? Or does that pose too much of a competitive risk? Let’s discuss in the comments!

What's Your Reaction?