Trade War Turmoil: Markets React to US-China Tensions

Recent trade war dynamics between the US and China have led to significant market turmoil, with global risk assets experiencing a sharp decline. What does this mean for the tech sector and investor sentiment? Read on for an in-depth analysis.

The ongoing trade war between the US and China has returned to the forefront, causing a ripple effect across global markets. After a brief respite, investors are once again grappling with uncertainty as tariffs and trade restrictions create chaos. This article explores the latest developments in the trade war, their impact on the financial markets, and what it means for the future of the tech sector.

Market Reaction and Declining Stocks

On Wednesday, global stock markets faced a substantial downturn, with shares in Asia, Europe, and Wall Street futures all trading in the red. The sell-off was predominantly driven by the tech sector, particularly following news that Nvidia anticipates a staggering $5.5 billion loss due to US government restrictions on its H20 chip sales to China. This development has raised alarms regarding the future of the semiconductor industry and its earnings potential.

Further complicating matters, a disappointing earnings report from Dutch chip equipment maker ASML Holdings has fueled concerns about the ramifications of the trade war. A gauge tracking Chinese technology shares in Hong Kong plummeted by as much as 4.9%, highlighting the fragility of investor confidence amid escalating tensions.

Broader Implications of the Trade War

The latest developments signal a potential expansion of the trade war beyond mere import taxes, with implications that could significantly hinder China's ambitions to establish itself as a leader in the global AI landscape. Investors are left navigating a volatile market where sentiment swings wildly with every piece of news.

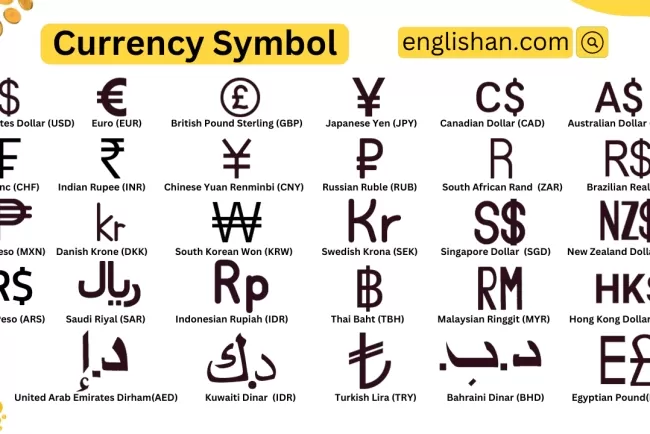

In response to the intensifying concerns, the US dollar fell to a six-month low, as traders sought refuge in safer assets. The Swiss franc also experienced a rally, further indicating a shift in investor behavior towards more stable currencies.

Impact on Commodities and Precious Metals

The commodities market has also felt the brunt of the trade war dynamics. Oil prices initially dipped for the second consecutive day as fears of a glut grew amidst the ongoing tension. However, prices rebounded slightly after news broke that China is open to trade talks with the US, suggesting a glimmer of hope for resolution.

On the other hand, gold prices soared over 2%, surpassing $3,300 an ounce for the first time, marking a new all-time high. The surge in gold prices reflects increasing investor demand for safe-haven assets amid economic uncertainty.

Conclusion

As the trade war between the US and China escalates, market volatility is likely to persist. The recent developments highlight the interconnectedness of global markets and the tech sector's vulnerability to geopolitical tensions. Investors must remain vigilant and adaptable, as each new piece of information can drastically alter market sentiment and trading strategies. The path ahead may be fraught with challenges, but a potential opening for dialogue between the US and China could pave the way for a more stable economic landscape.

Stay tuned for further updates on the evolving situation and its implications for global markets.

What's Your Reaction?