India's Leading Taxpayers: A Vital Role in Nation Building...!!!

The highest taxpayers in India play a crucial role in supporting the country's economic infrastructure and development. These individuals and corporate entities not only showcase their financial success but also demonstrate their responsibility towards contributing to the nation's growth.

Introduction

Taxation is a fundamental aspect of every country's economy, and India is no exception. The highest taxpayers in India play a pivotal role in contributing to the nation's revenue, which is channeled into various developmental projects and public welfare initiatives. This article explores the top taxpayers in India, emphasizing their contributions and the impact of their taxes on the economy.

Top Individual Taxpayer

Remarkably, the highest taxpayer in India is not a business magnate but a Bollywood superstar. Akshay Kumar topped the list of individual taxpayers for the financial year 2021-22, paying an impressive ₹29.5 crore in income tax. Akshay Kumar's earnings, which amounted to ₹486 crore, were primarily derived from his acting career, production house, sports team, and brand endorsements.

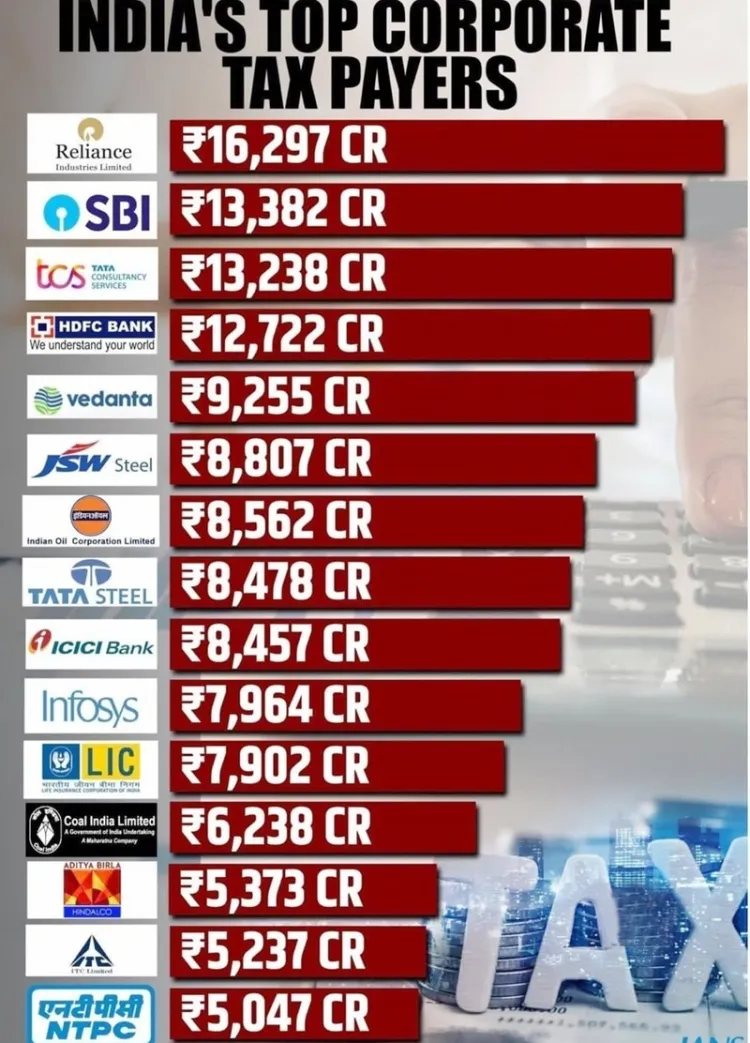

Top Corporate Taxpayers

Several prominent companies lead the way when it comes to corporate taxpayers:

-

Reliance Industries Limited (RIL): As India's largest private sector corporation, RIL paid the highest tax amounting to ₹20,713 crore during the financial year 2022-23.

-

State Bank of India (SBI): The largest public sector bank in India, SBI contributed ₹17,649 crore in taxes for the same financial year.

-

HDFC Bank: One of India's leading private sector banks, HDFC Bank paid ₹15,350 crore in taxes.

-

Tata Consultancy Services (TCS): The IT giant paid ₹14,604 crore in taxes, making it one of the top taxpayers.

-

ICICI Bank: Another major private sector bank, ICICI Bank contributed ₹11,793 crore in taxes.

-

Oil and Natural Gas Corporation (ONGC): The largest government-owned oil and gas explorer and producer in India, ONGC paid ₹10,273 crore in taxes.

-

Tata Steel: Established as Asia's first integrated private steel company, Tata Steel paid ₹9,214 crore in taxes.

-

Infosys: A global leader in technology services and consulting, Infosys contributed ₹9,214 crore in taxes.

-

Bajaj Finance: A leading non-banking financial company, Bajaj Finance paid ₹8,500 crore in taxes.

-

Larsen & Toubro (L&T): A major construction and engineering company, L&T contributed ₹8,000 crore in taxes.

Impact of High Tax Contributions

The contributions of these top taxpayers are instrumental in funding various government initiatives, including infrastructure development, healthcare, education, and social welfare programs. Their taxes help bridge the fiscal deficit and promote economic growth.

Challenges and Considerations

While high tax contributions are commendable, it is essential to ensure that the tax system is fair and transparent. The government must continue to implement measures to prevent tax evasion and ensure that all taxpayers, regardless of their status, contribute their fair share.

Conclusion

The highest taxpayers in India, both individuals and corporations, play a vital role in supporting the nation's economy. Their contributions are crucial for the development and progress of the country. As India continues to grow, it is essential to maintain a robust and equitable tax system that encourages compliance and fosters economic prosperity.

What's Your Reaction?