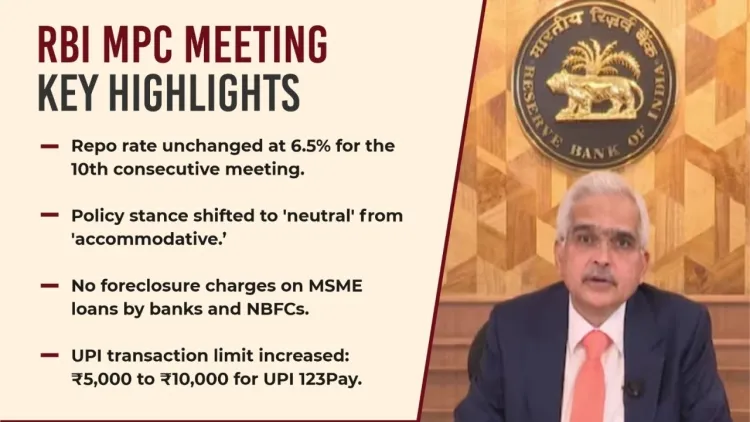

Key Highlights of the RBI MPC Meeting...!!!

The recent RBI MPC meeting reflects a balanced approach to monetary policy, aiming to support economic growth while keeping inflation in check.

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) recently convened and decided to cut the repo rate by 25 basis points, lowering it from 6.5% to 6.25%. This is the first rate reduction in nearly five years since the pandemic-induced cut in 2020.

Key Highlights of the RBI MPC Meeting

Repo Rate Cut

The MPC's primary decision was to reduce the repo rate by 25 basis points. This move aims to stimulate economic growth while ensuring that inflation remains within target levels. The committee considers a less restrictive monetary policy stance appropriate given the current economic conditions.

Economic Projections

The RBI has projected India's GDP growth for the financial year 2025-26 at 6.7%. This forecast accounts for improvements in agriculture, consumption, and manufacturing activities. The inflation projection for FY26 is set at 4.2%, suggesting a positive outlook for price stability.

Neutral Policy Stance

Despite the rate cut, the MPC has chosen to maintain a neutral policy stance. This approach allows the committee to remain flexible and responsive to changing economic conditions. RBI Governor Sanjay Malhotra emphasized that the less restrictive policy applies only to the current meeting and does not indicate a long-term shift in stance.

Global Uncertainties

The MPC acknowledged the challenges posed by global uncertainties, including instability in international financial markets and ongoing trade policy issues. These factors have been considered in the decision-making process, with the committee remaining vigilant about their potential impact on growth and inflation.

Support for Growth

Governor Malhotra underscored the importance of supporting economic growth while maintaining price stability. The rate cut is expected to benefit sectors such as MSMEs, which rely on affordable credit to sustain and grow their operations. The RBI remains committed to providing adequate liquidity to the banking system and ensuring financial stability.

The recent RBI MPC meeting reflects a balanced approach to monetary policy, aiming to support economic growth while keeping inflation in check. The rate cut and neutral stance are expected to create a conducive environment for sustainable economic development. The RBI will continue to monitor macroeconomic conditions and make adjustments as necessary to achieve its objectives.

What's Your Reaction?